Uncategorized

SBA Releases Simplified PPP Forgiveness Application and Revised Standard Application While Providing Additional Guidance

Last week the SBA issued a Simplified PPP Forgiveness Application, Form 3508 EZ, that streamlines the forgiveness process for certain applicants as well as provided additional guidance.Who is eligible to use Form 3508EZ? Self Employed Individuals and General Partners that did not include any employees in the Borrower Application Form that was submitted to the…

Read MoreImportant Changes to Paycheck Protection Program

On June 5, 2020, President Trump signed the Paycheck Protection Program Flexibility Act Of 2020 into law thus allowing businesses a greater opportunity to use PPP funds received in conjunction with the progression of their activity. This change should increase one’s chances of allowing the loan to be completely forgiven. THE FOLLOWING ARE THE KEY PROVISIONS OF THE ACTExtension of Covered Period…

Read MorePPP forgiveness application—What borrowers need to know

If you missed our May 26th webinar on the PPP Loan Forgiveness Application, you can find the recording here. Please do not hesitate to contact us with any additional questions. Watch the Webinar Download Slides

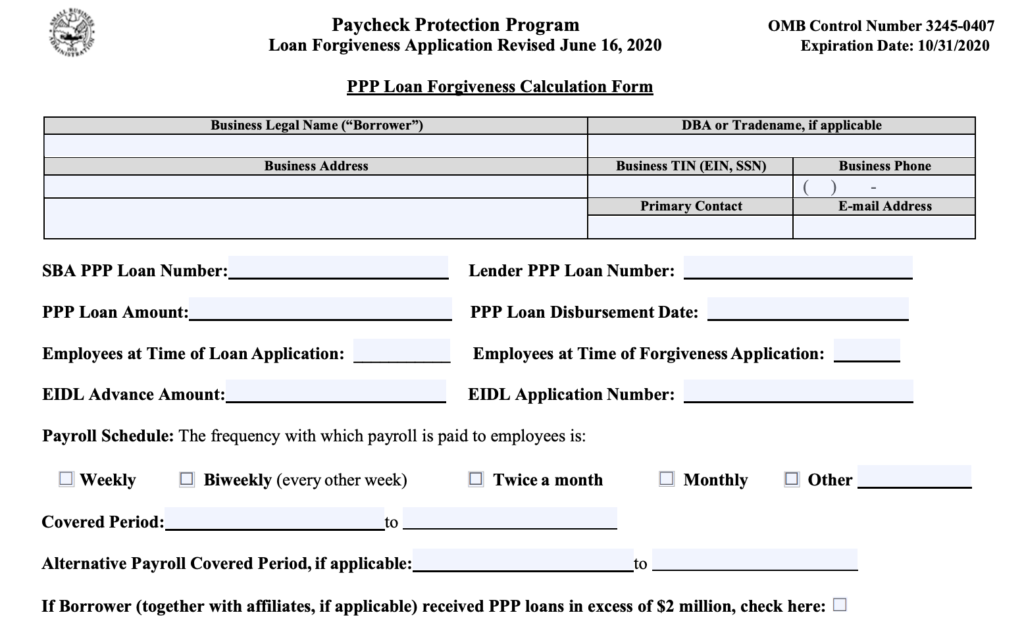

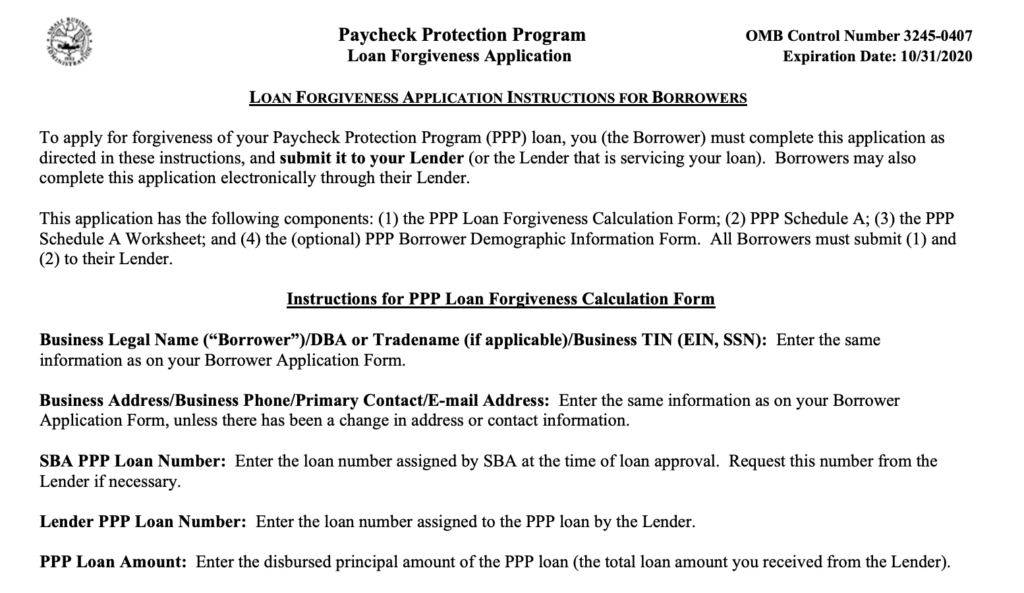

Read MorePPP Loan Forgiveness Application

The SBA has released their PPP Loan Forgiveness Application. Download the Application. We will be hosting a webinar on May 26th to answer your questions. If you are unable to attend, please contact us and we will be happy to assist you.

Read MorePPP Forgiveness Application – Webinar, May 26th

Join Steven Mizrach, CPA, of Dorfman Mizrach & Thaler, in partnership with Nixon Peabody on May 26 at 1:30pm EDT for an update on the Paycheck Protection Program (PPP) forgiveness application and what small businesses need to know when applying. Topics to be discussed include: • PPP program and new guidance updates • Update on…

Read MoreCOVID-19 Update—Latest Developments Involving the CARES Act and FFCRA

In case you missed our April 3rd webinar, we shared insight regarding the CARES ACT and FFCRA in a joint webinar with Nixon Peabody. The recording and slides can be found below. Please feel free to contact us with any questions. Webinar Recording Powerpoint Slide Deck

Read MoreCOVID-19 Update -So you applied for a Paycheck Protection Program loan

On April 21st, we participated in a webinar discussing next steps after you’ve applied for a PPP loan. Below is a recording from the video as well as a copy of the slide presentation. If you have any questions, please contact us to discuss your specific issue. Webinar Recording Powerpoint Slide Deck During the session…

Read MoreDental Service Organizations: Beware of New Jersey’s Enhanced Restrictions

This article is a guest post written by Michael F. Schaff, Esq. and Peter Greenbaum, Esq., Wilentz, Goldman & Spitzer, P.A. Organizations that provide support to dental practices need to be keenly aware of whether the state they are providing support services has corporate practice of dentistry (“CPOD”) restrictions. CPOD restrictions are state specific and…

Read MoreThree Common Pitfalls to Avoid for Emerging Group Dental Practices

Guest post from Perrin DesPortes, Jr., TUSK We work with a lot of group dental practices and DSOs all over country. Some are based around general dentistry and others are specialty-focused. Some have three 20-operatory practices and others have ten 6-operatory facilities. Some have centralized infrastructure (call centers, insurance processing, marketing services, etc.) and others…

Read MoreDSO Tax Update – The 20% Pass Through Deduction – Final Regulations

nTreasury announces Final Regulations on Tax Deduction In January 2019, the Treasury issued final regulations that adds some clarity in determining how DSO’s and it’s investors can benefit from the 20% Pass Through Deduction. This is our third post on this ever evolving matter. Here’s What We Knew (Thought) If an owner of a dental…

Read More